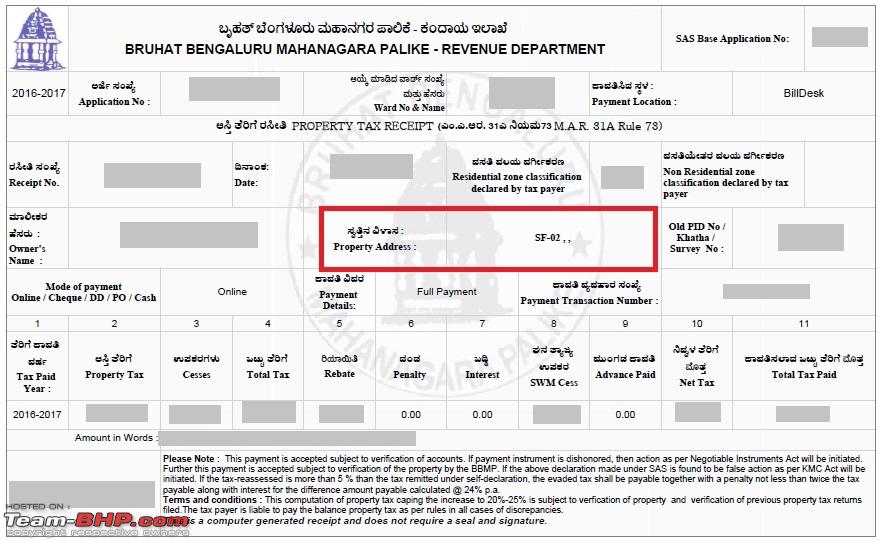

Bbmp Tax Paid Receipt Print

Taxes serve as one of the primary sources of revenue for the Government, enabling them to develop and maintain essential infrastructure and amenities like construction and maintenance of roads and parks, cleanliness of the locality, efficient drainage, etc. There are certain taxes that are levied by the Government of India, like,, etc. Similarly, there are certain other taxes that are levied by the different states of the country.

Add 2nd edition deities and demigods pdf. Pp. 94, 104.. Dicing with Dragons, An Introduction to Role-Playing Games (Revised ed.)... () •; (1980). • ^ Slack, Andy (Feb–Mar 1981). Buffalo, New York: Prometheus Books.

BBMP’s updated property tax website enables citizens to pay their property taxes easily. For property owners with no alteration in the structure, usage, or tenancy of their property, the process has been made easy as compared to last year. Pay before April 30th to avail a discount of 5%.

Property Tax is one such tax that is levied by the State Government and is payable by the residents of that state through a local body like the state municipality. This tax acts as revenue from real estate like vacant land, residential apartments, commercial complexes, warehouses and shops, owned by a resident. As this tax is paid indirectly paid to the State Government through the relevant municipality, it has an effect on the method of computation and mode of payment. Therefore, if you own property in Bangalore, it is essential for you to have a thorough knowledge about these minute details, so that you are well aware of the that you have to pay to your State Government. If you own a property in Bangalore, you are liable to pay property tax to the state’s municipal body, known as Bruhat Bengaluru Mahanagara Palike (BBMP), payable every year. The BBMP abides by the Unit Area Value (UAV) system, for computing the taxable amount towards property tax.

Soal latihan matematika smp kelas 7 kurikulum 2013. The UAV is calculated based on estimated returns from the property, taking into consideration various factors like type and location of the property. The property tax calculation is done by multiplying the area occupied by the property by the fixed rate of its per sq. Tax in a month (UNIT), which is again multiplied by the existing property tax rate (VALUE). Tax rate is determined by the current value of the property, depending on its location.

The jurisdiction of the BBMP is categorised under six value zones, as per the guidance value mentioned by the Department of Stamps and Registration. The 6 forms for paying property taxes in Bangalore are: Form I: Form I is applicable when the owner of the property has its PID (Property Identification Number), a dynamic identification number allocated to his/her property that comprises of detailed information related to the plot, road and ward of the property. Form II: Form II is relevant when the property owner does not possess the PID but has a Katha number, the unique number of the Katha certificate issued for his/her property and includes all the essential details of the concerned property. Form III: This form has to be submitted by a property owner who neither has the PID or the Khata number. Form IV: Form IV is a white form that has to be submitted when there are no changes involved in the property information related to increase or decrease in the property size, or any alterations in statues.

Form V: Form V is a blue form that is required by owners whose property has undergone some changes like construction of another floor, demolition of the property, transition of the property from residential to non-residential or vice-versa, transition of its status from under-construction to constructed, etc. Form VI: This is the form that is relevant for property owners who are eligible for tax exemptions from property tax. The service charge that has to be paid can be done through this form. The property tax in Bengaluru for all properties – self-occupied, tenanted, vehicle parking, can be calculated using this formula: Property tax (K) = (G – I)*20% + Cess (24% of property tax) G - Gross unit area value, which is the result of A+B+C I - G*D/100 A - Tenanted area of property rate of property per sq.

10 months B - Self-occupied area of property rate of property per sq. 10 months C - Vehicle parking area rate of vehicle parking area per sq. 10 months D - Depreciation percentage, based on the age of the property The following steps break down the formula to simplify the property tax calculation.

• Known the exact details of your property - built-up area, value per unit area and the depreciation • Multiply the value of the built-up area and the value of the unit area, and then multiply it by 10 (denoting 10 months) • Deduct the depreciation from this value to get the total annual value of the property. • Calculate 20% of the total annual value of the property to get property tax value • Calculate 24% of this property tax to get the cess amount • Add the property tax to this cess to arrive at the final payable property tax • The property owner will be able to avail a rebate of 5%, if he/she pays the property tax before the due date, that is, 30th April of the assessment year • Deduct 5% from the final value of property tax to get the discounted property tax amount. Let’s take a look at certain things you need to consider while calculating your property tax: • Built-up area should not include cars parked in verandas and open car parks. Areas occupied by cars parked in verandas and open car parks have to be deducted from the built-up area.